bear trap stock term

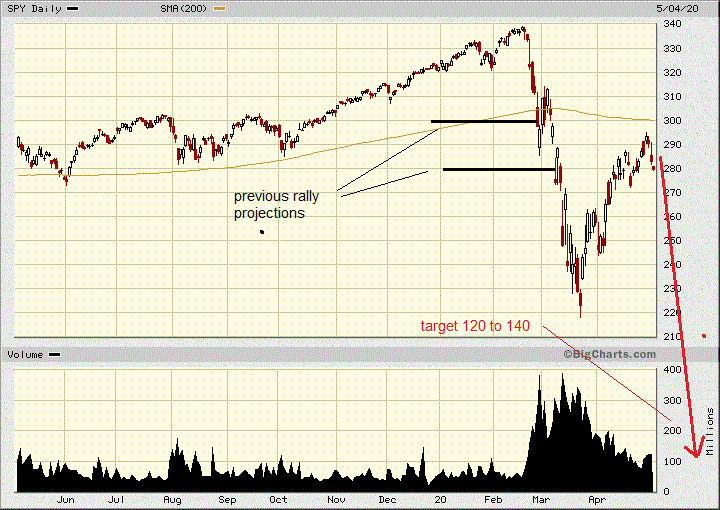

In the first couple years of the dot-com bust I tallied at least eight significant. The second wave of buying comes into play once the strong shorts realize that this is not just a dead cat bounce but that the move has legs.

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

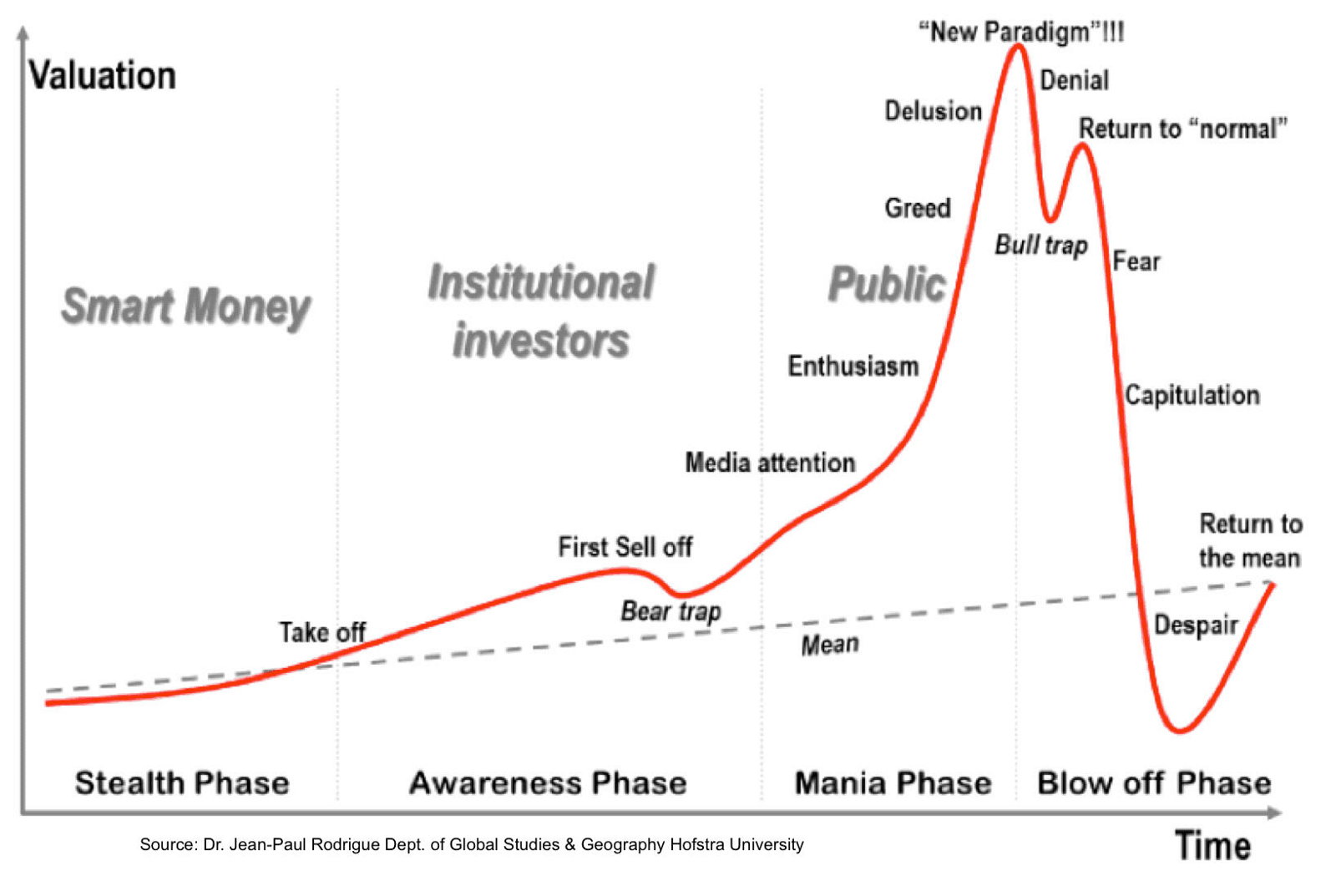

Bear trap trading is also commonly associated with institutional investors.

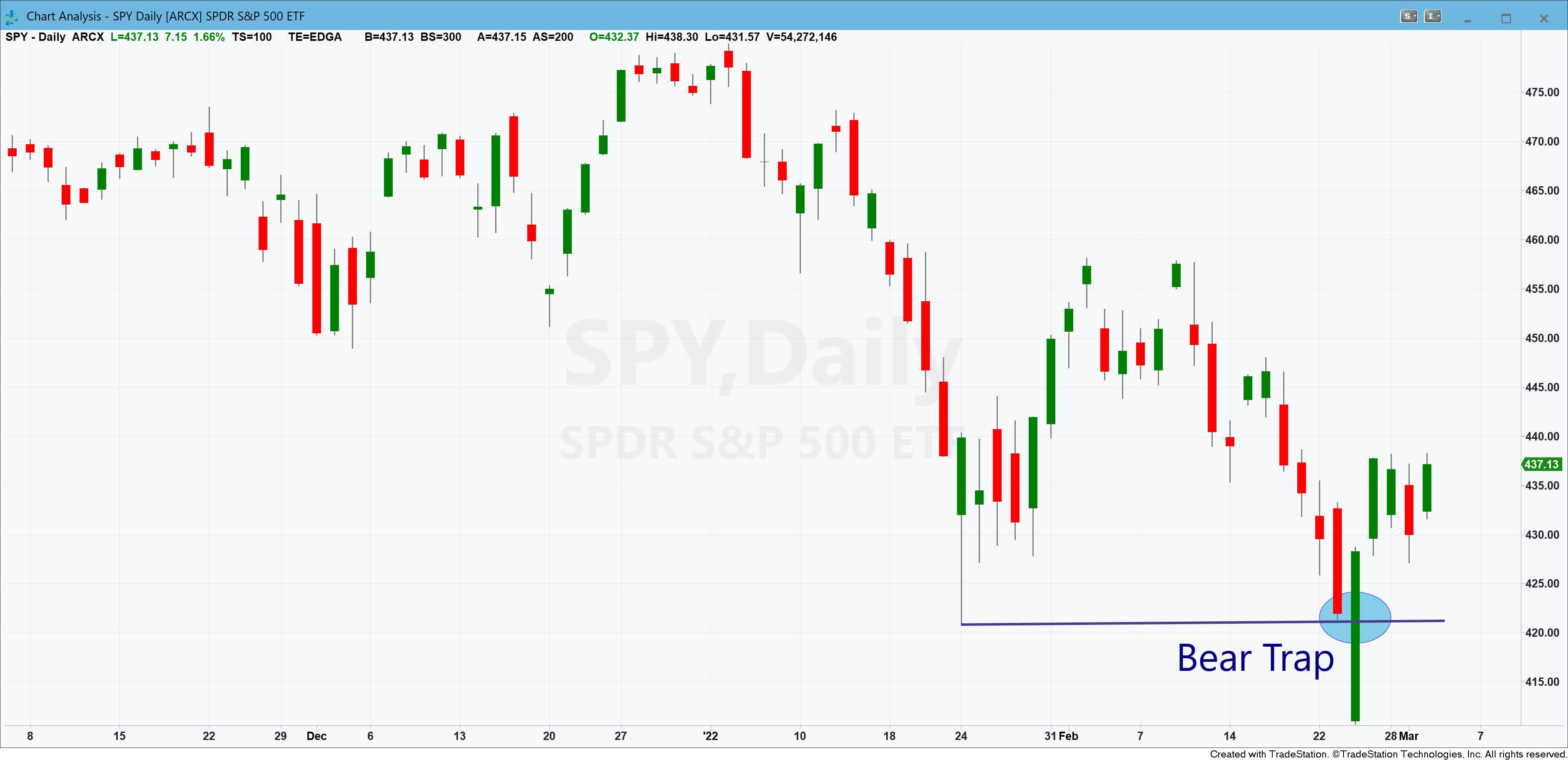

. The bear trap occurs when the bears find they must repurchase the shares from an individual or a group at an artificial price determined by the seller. Bull traps and bear traps are forms of the whipsaw pattern which describes the movement of stocks in a volatile market where the stock suddenly switches direction. The basic definition of a bear trap trading is when a bearish chart pattern occurs and falsely signals a reversal of the rising price trend.

What Is a Bear Trap When Trading. An accumulation of shares being sold short by bears trying to drive down the price of a stock. Bear traps spring as brokers initiate margin calls against investors.

Bear Trap Stock is a term used in the stock market to describe a particular type of investment. What is Bear Trap in the Stock Market. Then when the price comes down due to heavy selling volume retail investors swoop in to purchase shares at a discount in bulk which drives.

In bear traps there is a general expectation that the market is going to fall. Based on the anticipation of price movements which. You think price is going to fall and continue down and it doesnt.

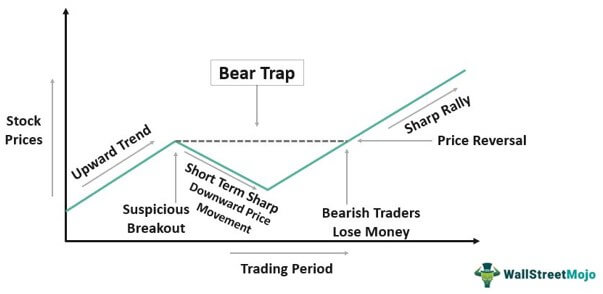

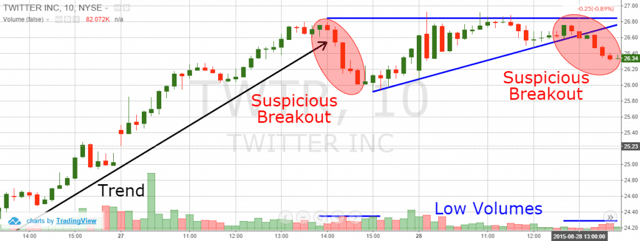

A bull trap may also refer to. The intention is to persuade other market participants that a price correction is taking place and for them to sell their own holdings in response thus driving prices down even further. It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward trend.

A Bear Trap is a device that is used to capture bears. Short-term rebounds are common at the start of a down market. This will produce the second bounce which will often precede the short-term top in the counter move.

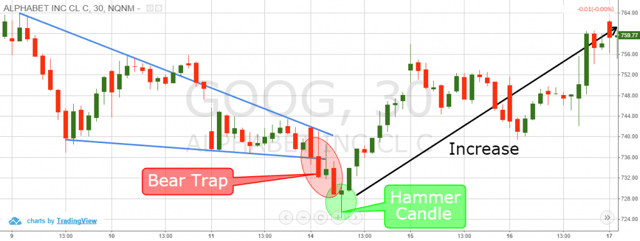

Finocent August 22 2021. What you see is a reversal pattern that has formed on an uptrend. A bear trap is a trading term used to describe market situations that indicate a downturn in prices but actually leads to higher prices.

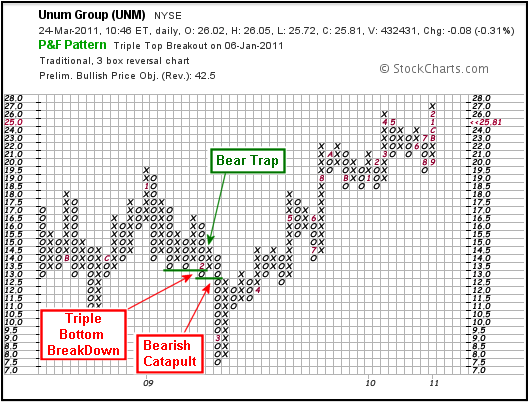

A bear trap is a technical stock trading pattern reflecting a misleading reversal of an upward trend in the financial market. Hence a false reversal of a declining price trend can be described as the trap. Together they will arrange to sell a large amount of that coin at the same time.

Beware the Bear Trap Disguised as a Stock Rally. A bear trap will generally involve a number of traders who have significant combined holdings of a cryptocurrency. Track your portfolio 24X7.

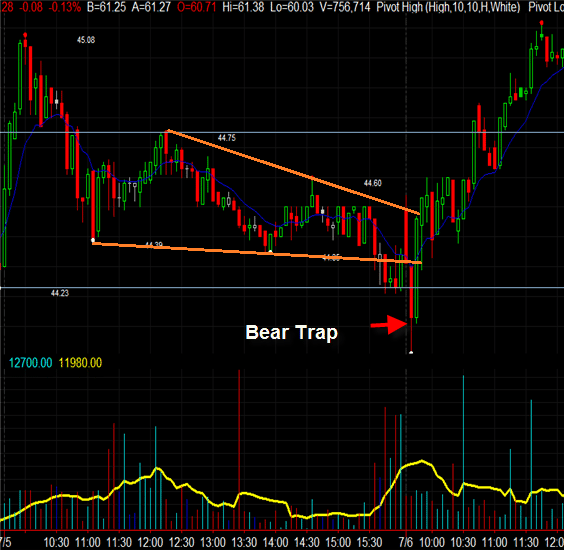

While not an indicator a bear trap is a technical trend or pattern that can be seen when the price movement of a stock or any financial security signals a false reversal from a downward to an upward trend. Below is an example of a bear trap on 76 for the stock Agrium Inc. Institutions must weed out amateurnovice traders in order to increase demand and drive stock prices upward.

A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively. A Bear Trap occurs when a stock that has been declining suddenly reverses and starts to rise. Rising stock prices cause losses for bearish investors who are now trapped Typically betting against a stock requires short-selling margin trading or derivatives.

Bear Trap Chart Example. If youre thinking about short-selling or have done any research you might have heard the term bear trap This is what happens when a stock or other security stops dropping and unexpectedly begins rising. Bear traps occur when investors bet on a stocks price to fall but it rises instead.

Amateur traders fall into the trap of believing this suspicious temporary breakout to continue as a long-term downward trend and begin selling their short positions only to incur a loss. A Bear Trap is a device that is used to capture bears. There are many ways to lose money in down markets and buying fleeting rebounds is among the best.

The move traps traders or investors that acted on the buy signal and generates losses on resulting long positions. Invest in Direct Mutual Funds New Fund Offer NFO Discover 5000 schemes. Invest In MC 30.

They accomplish this by driving prices lower in order to create the illusion that the stock or market is turning pessimistic. The Nasdaq Composite Index boomeranged 10 last. MC30 is a curated basket of 30 investment-worthy.

These are unexpected movements that can incur great losses to traders if they are not careful. In the stock market traders depend on technical indicators to help them trade effectively. In general a bear trap is a technical trading pattern.

They accomplish this by driving prices lower in order to create the illusion that the stock or market is turning pessimistic. Many investors who have been watching the stock decline will sell it at this point because they believe that the trend has reversed and the stock will continue to go down. When the performance of an index stock or other financial instrument incorrectly signals a reversal of a rising price trend a technical pattern that occurs this is known as a bear trap.

Institutional investors may seek to stimulate interest in a stock which encourages retail investors to sell and take profits. The creation of a bear trap involves the careful planning and execution of a set of circumstances in which there is sense of an impending short term fall in the price of a given security that will be followed by a long term upswing in the price. When this happens anyone who was betting on the stock to go down ends up losing money even if the stocks increase is only temporary.

Institutions must weed out amateurnovice traders in order to increase demand and drive stock prices upward.

Bear Trap Explained For Beginners Warrior Trading

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Stock Trading Definition Example How It Works

P F Bull Bear Traps Chartschool

What Is A Bear Trap Seeking Alpha

The Great Bear Trap Bull Trap Seeking Alpha

Bear Trap Explained For Beginners Warrior Trading

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Explained For Beginners Warrior Trading

The Great Bear Trap Bull Trap Seeking Alpha

/Clipboard01-c2c4a2d12c05468184b82358f12a1af5.jpg)